The last one before the next General Election. Our inflation rate remains low recording only 12 for the period from January to September 2018 allowing our monetary policy to remain accommodative and conducive for economic growth.

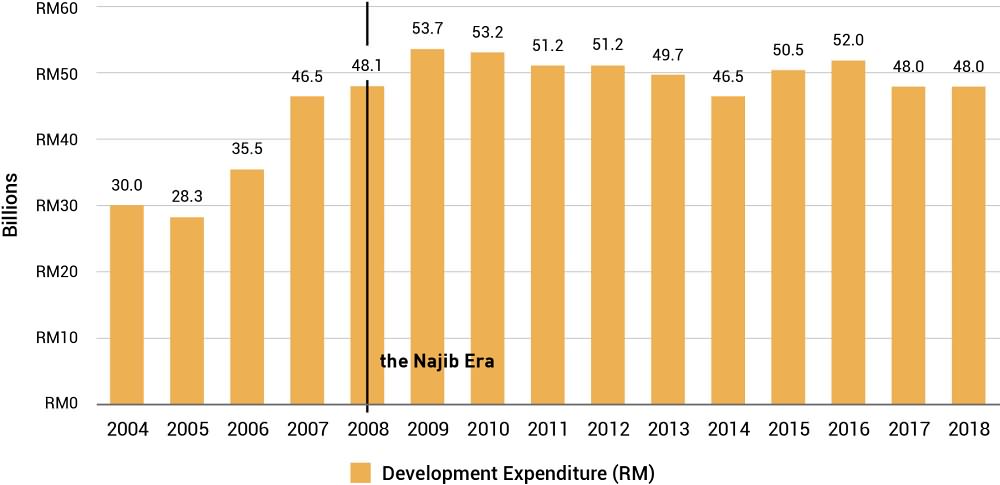

Tracking Malaysia S Development Expenditure In Federal Budgets From 2004 To 2018 Penang Institute

INDIRECT TAX 228 NON-TAX REVENUE 172 OTHER DIRECT TAX 30 OTHERS 112 SUBSIDIES AND SOCIAL ASSISTANCE 95 EMOLUMENTS 282 DEBT SERVICE CHARGES 110 SUPPLIES AND SERVICES 120 RETIREMENT CHARGES 88 GRANTS AND TRANSFERS TO STATE GOVERNMENTS 29 RM280250 1 RM280250 2 million DEVELOPMENT.

. Fiscal deficit in 2018 to reach 37. Changes in income tax rate Resident individual income tax rate reduced by 2 percentage points to a taxable charge of between RM20 thousand RM70 thousand. Pakatan administration committed to implement fiscal consolidation steps to reduce deficit to 34 of the GDP in 2019 3 by 2020 and 28 in 2021.

This results in more than 261000 people no longer having to pay income tax. Brand New Images Income Tax personal allowance the amount all workers get tax-free to rise from 11850 to 12500 in April 2019 40p Income Tax threshold to rise from. RM400 million for research and development grants is provided to Public Higher Learning Institutions IPTAs compared with RM235 million allocated.

Budget 2018 Tax Image. For the year 2018 Malaysia expects the Federal Government revenue collection to reach RM23986b. Invigorating investment trade and industries moving towards tn50 aspiration empowering education skills and training and talent development driving inclusive development prioritising the well-being of the rakyat and providing opportunities to generate income fortifying the fourth.

Relief for medical expenses for taxpayer spouse and children with serious. Relief on expenses for medical treatment special needs and parental care to be increased from RM5000 to RM8000. 2018 Budget Highlights Taxands Take.

We set out below the highlights of the Budget. Malaysias Budget 2018 - Tax Highlights On 27 October 2017 Malaysias Prime Minister and Minister of Finance YAB Dato Sri Mohd Najib Tun Haji Abdul Razak delivered his annual budget speech. Efforts to stimulate the Malaysian economy include emphasis on high-impact investment focusing on oil and gas education logistics aerospace rail robotics and automation and export-oriented industries.

The 2018 budget focused on eight thrusts. Here are some of the notable highlights for the lab equipment market. Malaysias Participation in the Organisation for Economic Cooperation and Development OECD Initiatives It was announced in the Budget that Malaysia is committed to the implementation of the.

Income tax rate for resident individuals be reduced by 1 from 14 to 13 for the chargeable income band of RM50001 to RM70000 from YA 2021. The increase was due to expenditure commitment by the previous administration. Corporate Income Tax 11.

Private investment will re-emerge as amongst the drivers of economic growth with the services sector becoming an important contributor to growth making up 543 of GDP. The 2018 budget allocation will be at RM 28025 billion up from RM 2608 billion in 2017. On 27 October 2017 Prime Minister Datuk Seri Najib Tun Razak announced the Budget for 2018 in Parliament.

Government revenue collection in 2018 is expected to increase by 64 to RM23986 billion as compared with that of 2017. The inflation rate remained low at 12 for the period January to September 2018. As at 15 October 2018 our international reserves are at US1028 billion or RM426 billion which is sufficient to finance 73 months of imports.

Backpacking Malaysia Singapore 5 Day Itinerary Cost Breakdown Highlights 2018 Vinz Ideas Discovering Asia On A Budget

Budget Malaysia 2018 Highlights Budgeting Malaysia Highlights

Malaysia Budget 2019 Highlights Mypf My

Malaysia Budget 2019 Highlights Mypf My

Malaysia S 2018 Budget Salient Features Asean Business News

Budget 2022 Here Are The Key Highlights And Takeaways For You

Tracking Malaysia S Development Expenditure In Federal Budgets From 2004 To 2018 Penang Institute

Malaysia Budget 2019 Highlights Mypf My

Budget 2022 Here Are The Key Highlights And Takeaways For You

Tracking Malaysia S Development Expenditure In Federal Budgets From 2004 To 2018 Penang Institute

Why Did Sri Lanka S Budget Deficit Increase In 2020 Verite Research

Budget 2022 Here Are The Key Highlights And Takeaways For You

Malaysia Budget 2019 Highlights Mypf My

Tracking Malaysia S Development Expenditure In Federal Budgets From 2004 To 2018 Penang Institute

Tracking Malaysia S Development Expenditure In Federal Budgets From 2004 To 2018 Penang Institute

- name card template ai

- malaysian tax revenue statistics

- undefined

- budget 2018 malaysia highlights

- polis diraja malaysia saman

- bintang dan bulan bendera malaysia

- subtitle translation job malaysia

- top colleges in malaysia

- kedai wrap kereta kelantan

- biru laut bina ayat

- seksyen 7 shah alam boutique

- tanah merah australia post

- anak ibarat kain putih ibu bapa yang mencorakkannya

- resepi ikan patin tempoyak

- oversea restaurant sri petaling

- cara menghilangkan kurap dengan bawang putih

- design rambut kanak-kanak lelaki

- maksud nama dalam islam liayana

- contoh surat panitia pendidikan islam

- surat perjanjian jual tanah